One Stop For All Your Accounting and Tax Needs

Tax Advice & Planning

Get clear, tailored advice from Specialist Tax Advisers on complex tax matters. Whether it’s planning for property sales, inheritance, investments or residency, we help you make informed decisions and reduce your long-term liabilities.

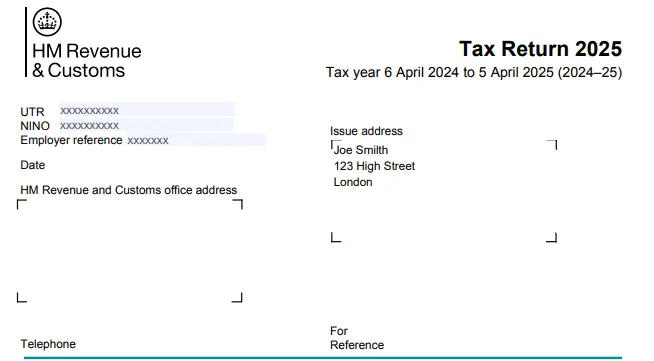

Tax Returns

Filling in a tax return can feel really daunting with so many rules, overriding provisions and the anti-avoidance measures. We take the stress away from your tax return filings, while ensuring that every relief and allowance is claimed. We also deal with HMRC directly on your behalf and ensure your return is filed correctly and on time.

One Off Tax Consultations

Need immediate clarity on a specific tax issue? Our one-off consultation service provides fast, decisive expert advice without the need for an ongoing engagement. Whether you're facing an urgent compliance deadline, considering a complex transaction like a major asset sale, or simply need an expert review of your current tax position, we deliver the focused guidance you need to make the right decision and ensure full compliance today.

Our Services For Individuals

Tax Advice & Planning

Get

clear, tailored advice from Specialist Tax Advisers on complex tax matters.

Whether it’s planning for property sales, inheritance, investments or

residency, we help you make informed decisions and reduce your long-term

liabilities.

Self Assessment Tax Returns

Stress-free filing with every relief and allowance applied. We deal with HMRC directly and ensure your return is filed correctly and on time.

HMRC Enquiries & Disclosures

From

undeclared income to full HMRC enquiries, we manage disclosures, negotiate

penalties and resolve issues with minimum stress.

Crypto Taxation

From disposals and staking to DeFi, we handle complex records across multiple exchanges. We prepare compliant reports that withstand HMRC scrutiny.Inheritance Tax & Estate Planning

Protect family wealth with smart use of gifts, trusts and exemptions. Reduce exposure and pass assets efficiently to the next generation.Residency & International Tax Matters

Cross-border rules are complex and easy to misinterpret. We confirm your tax residency, advise on split-year treatment, explain how the foreign income and gains regime affects you and apply double tax treaties to keep you compliant while avoiding unnecessary UK tax.What Makes Us Different

Tailored Advice

Never One Size Fits All

Invested In Your Success

We have helped our clients save millions

Big 4 Expertise

At a fraction of the price

Chartered Tax Advisers

Highest level of tax professionals in the UK

Fixed Transparent Pricing

No Surprise Bills

Ready To Take Stress Away From Taxes?

Our Typical Clients

High Income Employees

We offer bespoke advice to help you optimise your tax position.

Landlords

We help you at every stage of your property ownership journey - whether it's SDLT advice on purchase, income tax matters relating to your rental income or Capital Gains Tax on sale.

Investors

Our advice covers everything from shares, dividends, capital gains and cryptocurrency investments.

Expats and Non Residents

Understand your tax residency position under the Statutory Residence Test is critical, as it helps ensure that accurate taxes are paid and double taxation is avoided.

Families

Most families are concerned about their inheritance tax position and estate planning.... Rightly so, as IHT can eat away 40% of everything that took a lifetime to build. We help you understand your options and plan in advance.

Self Employed

Whether you are a freelancer, contractor or running a business as a self employed individual - we help to ensure that you pay the least amount in taxes by utilising all the reliefs available, while staying fully compliant.

Why Specialist Tax Advice Matters

UK Tax Rules Are Complex

Small mistakes can lead to:

Overpaid taxes

You may never recover

HMRC Penalties

That grow quickly

Stress and Uncertainty

About compliance

Common Risks We See

Which can easily be avoided with the right advice

Filings After Deadline

Leading to instant fines and penalties

Missed Reliefs

Most reliefs have a strict time limit for a valid claim with HMRC

Residency Confusion

Not understanding the rules can lead to double taxation

Frequently asked questions

Yes, if you are self-employed, receive rental or foreign income, have untaxed investment income or capital gains, need to claim reliefs not handled through PAYE, or are liable for the High Income Child Benefit Charge.

HMRC will charge an immediate £100 penalty if the tax return is not submitted by the deadline. Further penalties start applying 3 months after that. We ensure you stay on track, and where you are already late, we can prepare the return quickly and advise on penalty mitigation.

HMRC treats most crypto disposals as capital gains. Staking or mining may create income tax liabilities. We reconstruct transaction data across multiple wallets and exchanges to prepare compliant reports that withstand HMRC scrutiny.

Most disposals are reported via Self Assessment, but UK property sales with tax due must be reported within 60 days. We calculate gains, apply reliefs and ensure the correct reporting route is used.

Yes, but relief may be available under double taxation treaties. We apply the Statutory Residence Test to confirm your position, ensure split-year treatment where relevant, and offset overseas taxes against UK liabilities.

The earlier the better. Planning ahead allows use of gifts, trusts, and exemptions that reduce long-term exposure. We provide structured plans that balance tax efficiency with family objectives.

The government understands that life happens and therefore HMRC offers multiple disclosure facilities to report the undeclared income gains, whether arising from the UK or overseas.

Speak With A Tax Specialist

Get In Touch