Why Specialist Advice Matters

Missed Reliefs

Many landlords fail to claim valuable tax reliefs simply because they don't know enough. We understand both the accounting and tax needs of property investors, allowing us to provide the best advice possible.

Anti-Avoidance Provisions

Property is riddled with anti avoidance provisions which if not properly considered leads to significant taxes.

Property Specific Taxes

Taxes such as Annual Tax on Enveloped Dwellings (ATED) and Capital Allowances (CA) are often misunderstood.

Tax Efficient Structure

Operating with the right structure could be a difference between a profitable long term business and an unprofitable hobby.

Complex Rules

A complex web of taxes apply to property investors in the UK. Starting with SDLT on property purchase, income tax or corporation tax on the rental income and then capital gains tax on property sale.

👉 Professional Landlords - Multiple properties with complex structures

👉 Buy To Let Investors - Rental income from various personally owned properties

Our Typical Clients

👉 Non Resident Landlords - Non residents with income from UK property

👉 Property Partnerships - Jointly owned properties generating rental income

👉 Accidental Landlords - Rental income from previous residence due to upsizing

👉 Trusts and Estates - Executers and trustees with UK property rental income

What We Can Help With

Stamp Duty Land Tax (SDLT)

Whether you are a first time buyer purchasing your main residence or a serial investor with a portfolio of properties across various structures, seeking to understand your SDLT position. Look no further - we can assist with all transactions ranging from simple residential purchases to mixed use and commercial property purchases

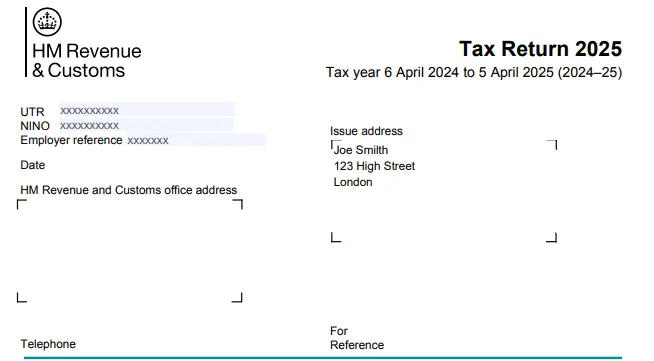

Landlord Tax Returns

Rental income from personally owned properties needs to be reported to HMRC on the individual's self assessment tax return and the income generated by limited companies needs to be reported on the company's corporation tax return. Being a firm of Chartered Certified Accountants and Chartered Tax Advisers, we can help with all compliance matters from limited company accounts to tax returns, ensuring full compliance with HMRC and Companies House.

Capital Gains Tax

Most UK property sales needs to be reported to HMRC within 60 days of the transaction taking place. We help you compute the capital gains and claim all potential reliefs, helping you pay the least possible capital gains tax while being fully compliant. We also take care of all the HMRC submissions, putting your mind at ease.

Structuring Advice

Should you own a property under your personal name, jointly with a partner, under a limited company or a group structure? These are all very important considerations and your decision today can have significant impact on the net money you get to keep in your hands. Therefore, it's crucial to get the structuring right from the outset.

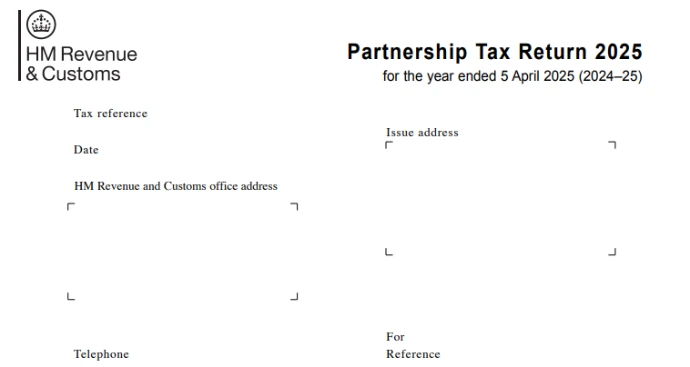

Property Partnerships

Partnerships have gained significant momentum over the past few years and they are quite straightforward to implement. However, the tax rules around property partnerships are anything but straightforward, and most accountants lack the necessary expertise to be able to provide an accurate partnership tax advice. That's where we excel, as we have worked with hundreds of partnerships and fully understand the tax rules and how partnerships can optimise their taxes.

Family Investment Company

Family Investment Company (FIC) is a very effective tool for Tax and Estate planning, that encompasses different classes of shares, ownership structures and trusts. FICs are very bespoke and created in line with the family needs and the long term objectives, to ensure that wealth can be passed from one generation to the next, without significant money being paid in taxes, enriching HMRC.

Let Property Campaign

Failed to report your rental income to HMRC? You still have time to make things right!

Let property campaign is a disclosure facility offered by HMRC to taxpayers who have received rental income from renting a property in the UK, but failed to report the rental income to HMRC. This could be due to a genuine oversight and HMRC tends to be reasonable if the taxpayers makes things right at the earliest opportunity. However, dealing with HMRC disclosures can be quite tricky due to the various statutory time limits, rules around allowable expenses and the discretion over penalties.

What Makes Us Different

Tailored Advice

Never One Size Fits All

Invested In Your Success

We have helped our clients save millions

Big 4 Expertise

At a fraction of the price

Chartered Tax Advisers

Highest level of tax professionals in the UK

Fixed Transparent Pricing

No Surprise Bills

Ready To Take Stress Away From Taxes?

Case Studies

01

Accidental Landlord

Sarah rented out her Manchester flat when she moved to London for work. She rented a flat in London and thought the rental income from her Manchester flat offsets the rent she pays in London.

She was wrong - HMRC sent her a nudge letter and she reached out to us to get things right. We disclosed the rental income to HMRC through Let Property Campaign and the disclosure was accepted by HMRC. Sarah saved thousands in penalties

02

Non Resident Landlord

Ashley and James received rental income from their UK house when they moved to UAE. Their estate agent started withholding 20% tax, which is required per the legislation.

Both of them were British citizens and each of their rental income share was fully covered by their personal allowances. We filed the NRL1 form with HMRC to ensure they received full rental income without tax deduction at source and ensured that their tax returns are accurately completed.

03

Property Disposal

Michael sold a buy to let property and realised significant capital gains. He knew that he had to report the property sale on his self assessment tax return and pay capital gains tax.

However, he failed to realise that he also had to report the property sale on a 60 day UK Property CGT Return and pay the capital gains tax at the same time. Failure to do either would have resulted in penalties. We promptly computed the CGT liability and filed the return with HMRC.

04

SDLT

Maha and Asad were in the process of purchasing their dream home in Surrey for £1.5 million. Their purchase was being subject to 5% SDLT surcharge as Asad owned a small home overseas. These surcharge alone amounted to £75,000.

We worked with them to ensure that the overseas home was transferred to a separate legal entity, with the transaction cost being less than £2,000 and they did not have to pay any SDLT surcharge on the Surrey property, saving over £73,000.

Frequently asked questions

Yes, a tax return is required even if you are making a loss from renting out your property. This can actually be beneficial for you as you can carry forward the losses and utilise them against your future rental income.

Most expenses that are incurred wholly and exclusively for your property rental can be claimed. This includes repairs and maintenance, letting fee, property management fee, insurance and replacement of domestic items etc.

Expenses that are capital in nature or not incurred wholly and exclusively for your property rental cannot be claimed against the rental income. This includes property improvement expenses and any expenses that were not necessary to carry out the property rental.

Most property disposals are reported via Self Assessment, but UK property sales with tax due must be reported on a capital gains tax on UK property return within 60 days. Working with us means that we take care of the whole process and ensure your property sale is fully compliant and appropriately reported to HMRC.

Non residents landlords are subject to an immediate withholding tax at the basic rate, which needs to be deducted by the tenant or the estate agent before the rent is paid to the landlord. The landlord can fill in NRL1 form to receive the rental income without such tax deduction at source and instead pay their taxes through the self assessment tax return.

Non residents are required to report property disposals to HMRC on the capital gains tax on UK property return within 60 days of selling the property. This requirement applies regardless of whether they have made a gain or a loss.

You are not alone. The rules are complex and many people don't realise that they need to report the rental income on their self assessment tax return until it's too late. For this reason, HMRC operates a disclosure facility known as Let Property Campaign. This allows you to report the rental income to HMRC and pay appropriate taxes without having to submit or amend tax return for each missed tax year. Penalties and interest charges apply to such disclosures and therefore it's important to have expert representation to mitigate these charges.

Speak With A Tax Specialist

Simply pick a time that suits you best